Check Employment Status If You Work In Hair And Beauty

HMRC have published guidance for hair and beauty professionals navigating the confusion around hidden employment and employees in disguise.

This update comes just a few weeks after the hikes in employers national insurance costs.

This is a welcome resource to bringing clarity to a situation that has created confusion for many years.

The tax rules have not changed, this transparency does though make it much easier for business owners that do not have a tax accountant or advisor to guide them through the complex issues around hidden employment.

There are different ways of working in the hair and beauty industry. For example, being employed by a salon, barbershop or working freelance as self-employed.

Working freelance could mean you’re:

offering services from your own salon

working as a mobile hair stylist or beauty therapist either at your own home or a client’s home

renting a chair or room in a salon

For tax purposes you’re either employed or self-employed. To work out your employment status, you’ll need to consider the terms and conditions in your contract. You’ll also need to consider your actual day to day working practices. These will determine who must pay:

Income Tax

National Insurance contributions

VAT

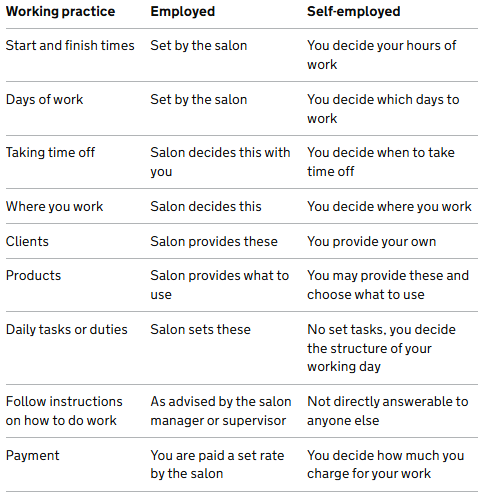

HMRC have included a handy list in the guidance, and if this doesnt help then the CEST tool can be used - this has also been updated to allow a category section for different industries, including hair and beauty!

Check out the list below and get in touch if you have any questions or concerns by emailing hello@thebeautyaccountant.co.uk

Tax doesn’t have to be complicated and it is great that HMRC are now providing even more clarity around employment status for tax. Remember Tax Law and Employment Law are separate you will still need to consult with a HR specialist to ensure your structure is correct.

If you need any help navigating tax and accounting for Hair and Beauty Professionals get in touch, we can help you.

Email hello@thebeautyaccountant.co.uk with any questions or concerns that you or your workers may have.

To read in full see Check employment status if you work in hair and beauty - GOV.UK